If you’re doing business in Colorado or planning to start a restaurant of your own, you need to know how the state’s minimum wage works. The wages you pay affect your bottom line, your employee satisfaction, and your ability to stay competitive. And since Colorado updates its minimum wage every year, it’s not something you can afford to ignore.

What is the minimum wage in Colorado?

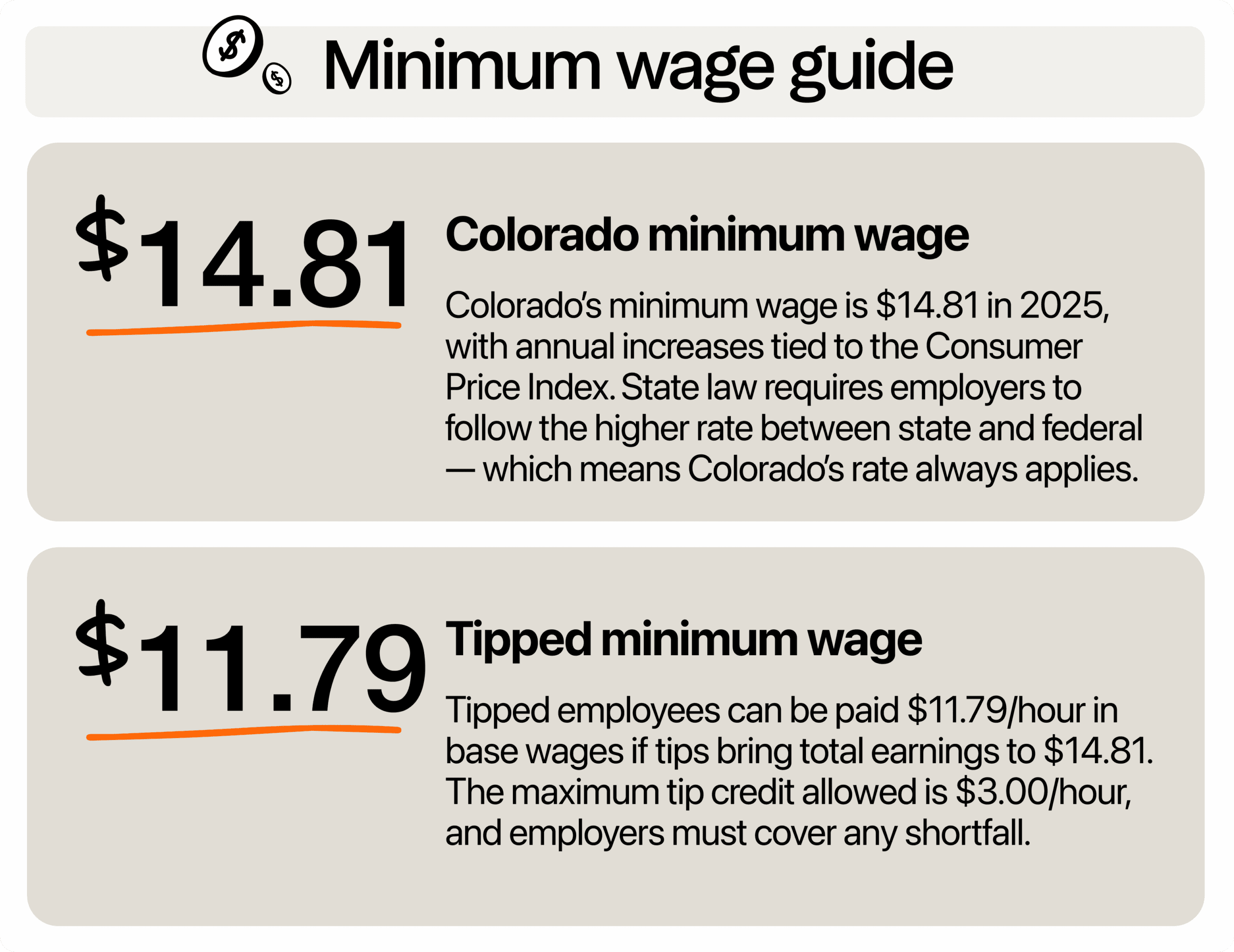

As of January 2025, Colorado’s minimum wage is $14.81 per hour. This applies to all eligible employees statewide and is adjusted annually based on the Consumer Price Index (CPI). Each year, the minimum wage increases according to the CPI, so while the rate is $14.81 for 2025, it will likely increase in future years to keep pace with inflation and rising living costs, aiming to help workers keep up.

In comparison, the federal minimum wage has remained at $7.25 per hour since 2009. That’s over a decade without any increase. Colorado, however, regularly updates its minimum wage each year. Because state law requires you to follow whichever wage is higher, you’ll always use Colorado’s rate for your employees.

Tipped employees

Colorado is a tip credit state with a minimum rate of $11.79 per hour. Employers can take a tip credit of up to $3.00 per hour, which allows them to pay tipped employees a lower base wage since tips are expected to make up the difference to reach the full minimum wage. For example, while their cash wage is $11.79 per hour, their total earnings should reach at least $14.81 per hour with tips. If tips fall short, you’re responsible for covering that gap.

It’s a system that encourages careful tip tracking, but it also helps you manage your payroll efficiently while supporting your staff’s income.

Youth workers and training wages

Colorado doesn’t have a separate training or youth wage, the way some other states do. That means all employees, regardless of age or experience level, are entitled to the full minimum wage. There’s no introductory or “learner” wage to fall back on.

So if you’re hiring high school students, seasonal help, or new workers who are just learning the ropes, you still need to start them at the minimum wage. That’s an important point to keep in mind if you’re budgeting for summer hires or short-term roles.

Local wage ordinances

Statewide minimum wage is one thing. But if you’re located in places like Denver, you’ve got local ordinances to keep an eye on, too. Denver has its own minimum wage law, and it’s often higher than the state rate. For example, in 2025, Denver’s minimum wage sits at $18.81 per hour. That’s a significant difference, and it matters for your payroll.

Here’s a quick snapshot of how some cities compare:

| City | Standard Minimum Wage | Tipped Cash Wage |

| Statewide (baseline) | $14.81 | $11.79 |

| Denver | $18.81 | $15.79 |

| City of Boulder | $15.57 | $12.55 |

| Boulder County | $16.57 | $13.55 |

If your business operates in multiple cities, or if you’re expanding soon, make sure you’re looking at each city’s rules. You don’t want to be caught off guard by local variations.

Special rules for overtime pay

Overtime pay is one of those areas where Colorado adds a few extra layers on top of what federal law already requires. Under both federal and state rules, non-exempt employees, meaning those who qualify for overtime, must be paid extra when they go over a certain number of hours. But Colorado’s version has a few more details you’ll want to pay attention to.

In Colorado, you must pay 1.5x the employee’s regular rate of pay when they work:

- More than 40 hours in a workweek

- More than 12 hours in a single workday

- Or more than 12 consecutive hours, regardless of when the shift starts or ends

Let’s say you have an employee earning the statewide minimum wage of $14.81 per hour. If they work overtime, that rate jumps to about $22.22 per hour. If they’re in Denver, where the local minimum wage is higher, their overtime rate increases as well based on that higher base.

This is why it’s so important to have reliable scheduling systems and accurate time tracking. These systems will save money in the long run and keep your employees happy because they know they’re being paid fairly.

Who qualifies for overtime protections?

Not every employee is entitled to overtime. Some positions are considered exempt from these rules. However, there are strict guidelines, and misclassifying employees can lead to serious legal issues.

To classify someone as exempt, their role must meet all three of the following criteria:

- Salary Basis Test: They must be paid a fixed salary, not by the hour.

- Salary Level Test: They must earn at least the minimum salary threshold. For 2025, the minimum salary threshold is $1,086.25 per week, which equals $56,485 annually. This threshold is expected to adjust annually with inflation.

- Duties Test: Their primary responsibilities must involve executive, administrative, or professional tasks. This includes managers, supervisors, department heads, and licensed professionals like accountants and engineers.

If an employee doesn’t meet all three tests, they’re considered non-exempt and must receive minimum wage and overtime pay. Even if someone is salaried, that doesn’t automatically make them exempt. Their job duties and earnings must align with the legal requirements.

What’s next for Colorado’s minimum wage?

By now, you’ve seen how Colorado’s minimum wage increases year after year. While the 2026 rate hasn’t been announced yet, you can expect Colorado’s Division of Labor Standards and Statistics to release the new number in the fall, around late September, followed by a public hearing and finalization in November or early December, with the new rate taking effect by January 1st.

This gives you a few months to evaluate your payroll, tweak your pricing if needed, and finalize your staffing plans before the new rate kicks in.

For you to stay informed, you can get direct updates from the Colorado Department of Labor and Employment (CDLE) website, where announcements, information, official notices, and breakdowns of wage rules are first published. You can also sign up for alerts via email so you never miss an important update that could affect your business.

Staying compliant

Wage compliance doesn’t have to be complicated if you have a clear process in place. Take a look at these practical steps to stay on track.

Keep payroll up to date

Use payroll systems that are flexible enough to adjust when wage laws change easily. This is especially helpful in Colorado, where the minimum wage is updated every January. With automated tools like these, you won’t have to scramble and worry about errors that could cost you.

And since Colorado is a tip credit state, you’re responsible for making sure your tipped employees earn at least the full minimum wage, including tips. If you’re still managing it manually, maybe it’s time to consider helpful tools such as tip management software. Such a tool can help you stay compliant, avoid disputes, and simplify reporting. Plus, your team will appreciate knowing their pay is being handled accurately and transparently.

Revisit employee classifications

Take some time every now and then to look over your team structure. Ask yourself: Are your salaried employees actually exempt based on Colorado’s rules? If they’re not, you might need to reclassify them and start tracking their hours like any other hourly worker. Don’t assume someone is exempt just because of their job title. What really matters are their day-to-day responsibilities and how they’re paid.

Monitor local wage laws

If your business is located in cities like Denver or Boulder, you already know that local wage rules can sometimes go above the state rate. And those changes don’t always follow the same schedule as the statewide increases. That’s why it helps to set up alerts through your city government’s website or follow your local labor department’s announcements.

You can also get ahead by joining your local chamber of commerce or business group. They usually stay on top of changes and send out helpful updates before anything becomes official.

Plan for cost shifts

Let’s face it: labor costs will keep changing, and you don’t want to be caught off guard. Start thinking about how rising wages fit into your pricing strategy. Can you tweak your menu prices, service rates, or fee structures slightly to help balance the increase? It’s also a good time to review your vendor contracts. Maybe there are areas where you can negotiate better deals to make room in your budget.

Is Colorado still a good place to do business?

We get that higher wages can feel like a hurdle. But here’s the truth: Colorado continues to be a strong place to run a business. Why? Because it offers stability, a growing economy, and a workforce that’s motivated by fair treatment. In 2024, Colorado continued its entrepreneurial momentum with 142,927 new business applications, maintaining its position as one of the top states for startup growth, according to the U.S. Chamber of Commerce. That kind of momentum shows that plenty of people still see real opportunity here, even with higher labor costs, and it’s proof that business owners are betting on Colorado’s future.

If you’re wondering whether paying higher wages can actually benefit your bottom line, the answer is often yes. Paying more upfront can save you more in the long run. When your team is fairly compensated, they’re more likely to stick around. That means less turnover, less time spent training new hires, and more consistency on the job. When employees feel valued, they put that value right back into your business with better service, stronger performance, and greater loyalty.

Fair pay is smart business in Colorado

Colorado’s minimum wage laws reflect the state’s broader commitment to building a strong, fair economy. Staying compliant isn’t just about rules. It’s about making smart moves that help your team thrive and your business stay resilient.

When you keep up with wage updates, plan ahead, and pay your workers what they deserve, you’re setting up a work environment people respect and want to be part of. That’s how you build stability, not just for your employees, but for your business, too.

Rebecca Hebert, Sales Development Representative

Rebecca Hebert

Sales Development Representative

Rebecca Hebert is a former restaurant industry professional with nearly 20 years of hands-on experience leading teams in fast-paced hospitality environments. Rebecca brings that firsthand knowledge to the tech side of the industry, helping restaurants streamline their operations with purpose-built workforce management solutions. As an active contributor to expansion efforts, she’s passionate about empowering restaurateurs with tools that genuinely support their day-to-day operations.